The industrial lubricants industry, particularly in Asia, is reshaping its supply channels and marketing strategies. Over the past five years, greater internet penetration among the region’s populations has brought about a tremendous growth in online retail usage, wherein lubricant marketers are finding a viable retail platform. Recognizing this opportunity are lubricant marketers in Asia, who are aligning their supply channels to optimize their operations. This allows them to maximize impact at the end-user level, while also minimizing costs in the back end of the supply chain.

The industrial lubricants industry, particularly in Asia, is reshaping its supply channels and marketing strategies. Over the past five years, greater internet penetration among the region’s populations has brought about a tremendous growth in online retail usage, wherein lubricant marketers are finding a viable retail platform. Recognizing this opportunity are lubricant marketers in Asia, who are aligning their supply channels to optimize their operations. This allows them to maximize impact at the end-user level, while also minimizing costs in the back end of the supply chain.

Top trends in the industrial lubricants market

In part, the industry is also evolving from a product development perspective. Globally, there is a greater emphasis on adopting sustainable strategies to reduce carbon footprint and greenhouse gas (GHG) emissions. But also, at a granular level this has also led great advancements in green chemistry. Emphasis on bio-based product development has changed the way in which companies are investing in lubricant R&D. Read on for some current trends in the industry.

#1 Biolubricants development

University of Northern Iowa’s Ag-Based Industrial Lubricants (ABIL) Research Program has licensed 16 formulated lubricants, greases, and base oils made of high oleic soybeans that have been genetically enhanced for stability. These products meet and exceed industry requirements, and many do not cost much more than their petroleum counterparts. If these products can compete in performance and price, their environmental benefits will make them even more appealing to users.

Due to their benefits, they will be more prevalent in applications where environmental and safety concerns are high, and less prevalent where petroleum products offer price and performance beyond those possible by bio-based products.

At the Institute of Science & Technology for Advanced Studies & Research (ISTAR), researchers have successfully modified Karanja Oil (a non-traditional vegetable oil) into biolubricants. The oil was first chemically modified through gas chromatography to study two main types of lubricants, i.e., lube oils and greases.

In the recent past, various academic institutes, along with collaboration with lubricant blenders across the globe, have conducted studies to identify viable production routes for lubricants through vegetable oils. One particular concern in the development route is that vegetable oils, if left untreated, lack oxidative stability, which in turn affects performance of the lube oils. Cases as stated above are absolutely crucial for commercialization of biolubricants produced through vegetable oil.

Furthermore, the consistent increase in R&D activities to develop improved bio-based lubricants and rising demand and usage of soybean and palm oil as raw materials will offer numerous opportunities for the growth of the global bio-based lubricants market.

Major oil companies in the space, such as Total, Shell, BP and ExxonMobil, are actively investing in R&D activities aimed at such development; since 2010, Total has doubled its R&D budget, across its two centers in Lyon, France, and Mumbai, India. The company, in 2014, filed 14 patents, and through 2010 to 2017, their average filings have averaged at five per year.

#2 Innovation in the supply chain

Manufacturing a product at an acceptable value for customers is a primary focus for suppliers. Companies in the lubricants industry have been redefining their supply chains from procurement of raw materials to customer delivery, including refining supply agreements to reduce costs, as well as radical shifts in customer delivery tools.

One such case is Petronas Lubricants International (PLI), whose Head of Global Supply Chain, Phil James, initiated a collaboration between the company’s technological and procurement and supply chain teams in a unified effort. This enabled the company to change its relationship with suppliers and transform their contracts, which will help realize the company’s goal of capturing the tier two lubricants space in the industry.

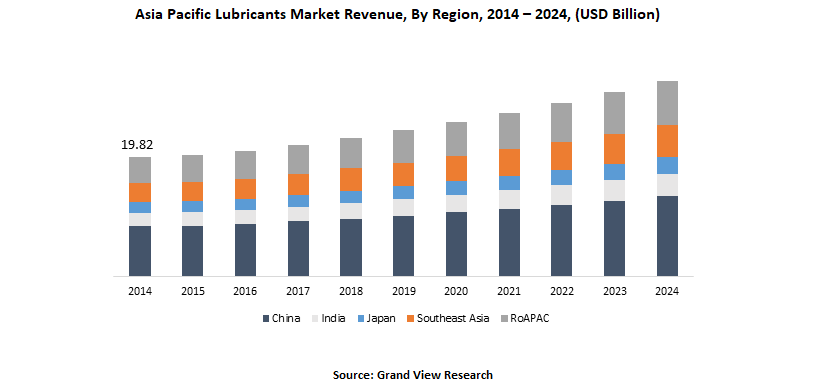

#3 Asian markets to outpace global growth rate

Economic stability and consistent growth in industrial output has put Asian markets on the global map, with demand for materials, oils, and energy on the constant rise. Such trends also have attracted western business entities to aggressively market their offerings to these countries, where on a parallel level, domestic companies aggressively expanded their operations to build upon the market expansion.

Such shift in competitive dynamics has established Asian markets, primarily South and Southeast Asian economies, as a converging point for companies globally. This is also evident in comparatively lower lubricant prices, and increasing offerings in the region.

As per the analysis by Grand View Research, India’s industrial lubricant demand is projected to grow at a CAGR (2016-2024) of 4.3 percent, against a global growth rate of 3.0 percent. Since 2012, the country’s GDP grew at an average of 6.9 percent, with industrial production growing at an average of 4.5 percent. Though these economic indicators suggest a robust demand for lubricants in the country, future growth is expected to be driven by lube oil demand in food processing, chemicals, energy, oil & gas, and textiles.

#4 Production expansions to minimize supply issues

Major lubricant companies are rapidly increasing their production capacities, mainly in Asia, to minimize supply issues in the future, considering that lubricants demand would increase by 18 percent by 2025.

In 2015, Total inaugurated its largest blending plant in Singapore which is slated to have a capacity of 310 kilo tons per year. On similar lines, ExxonMobil completed expansion of its Jurong, Singapore plant for synthetic lubricants and greases. Meanwhile, Shell inaugurated a 390 kilo ton integrated lubricants and grease production plant in Tuas, Singapore. In a move aimed at increasing Gulf Cooperation Council (GCC) and the South Asian Association for Regional Cooperation (SAARC) exports, India’s IOC Ltd. announced its intentions to expand on its current 400 kilo tons per year capacity.

#5 Regulations influencing lubricant packaging and specification standards

The lubricants industry, similar to other chemical sectors, has been under scrutiny by various regulatory agencies pertaining to environment, safe handling & storage, and disposal. A few such developments have a direct impact on the manner of operations conducted by lubricant blenders and marketers. Upgrading existing standards to include a newer class of chemicals will considerably raise the cost of lubricants at both manufacturer and supplier levels of the value chain.

Recent developments in the regulatory arena of the industry include U.S. EPA’s revision of Lubricants Group Standards in 2017. The updated mandate requires changes in lubricants’ labeling, advertising, packaging, disposal, supply, storage, and use.

Conversely, European Union has undertaken an initiative, known as European Commission’s Cumulative Cost Assessment (EC’s CCA), which aims to bring down the cost of regulations by eliminating redundant legislative texts and acts, and improve upon existing standards. As per the EC’s CCA, nearly 48 percent of the value added to products through regulations is concerned with emissions and industrial process legislations. The mandate undertaken by EU aspires to bring down such costs, and allow European companies to be more competitive with respect to pricing in global markets, and nurture a sustainable manufacturing ecosystem in the region.

What the future holds: Market overview

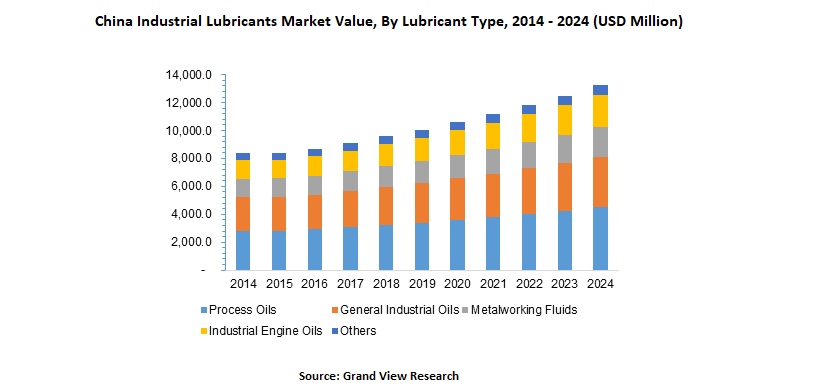

As per Grand View Research, the global industrial lubricants market is anticipated to be driven by growing end-use industries including chemicals manufacturing, food processing, and electronics particularly in Asia Pacific. Increasing demand for higher efficiency, sustainability and lower maintenance downtime of industrial equipment has led to high demand for these lubricants.

Rising demand for a range of manufactured finished goods along with the subsequent need to expand production capabilities has compelled manufacturers to rely on machinery to automate their production process and processing activity. Keeping machinery functioning smoothly, and preventing equipment failure with appropriate lubrication are expected to be the key driving factors for industrial lubricants over the forecast period.

About the author:

Harsha Jandhyala currently works as a Team Lead at Grand View Research in the chemicals team. His primary focus is on assessing new market opportunities, analysing governmental and regulatory policies, market sizing & forecasts. He has expertise in various industries that include specialty chemicals, renewable chemicals, and polymers.

Harsha Jandhyala currently works as a Team Lead at Grand View Research in the chemicals team. His primary focus is on assessing new market opportunities, analysing governmental and regulatory policies, market sizing & forecasts. He has expertise in various industries that include specialty chemicals, renewable chemicals, and polymers.

With five years of experience in market research, business intelligence, consulting and strategy building. Harsha began his career as a structural engineer, before being promoted to the position of project manager with various construction companies. Later on, his career guided him to the chemicals and materials sector, where he worked as a strategic consultant.

The views, opinions and technical analyses presented here are those of the author or advertiser, and are not necessarily those of ULProspector.com or UL Solutions. The appearance of this content in the UL Prospector Knowledge Center does not constitute an endorsement by UL Solutions or its affiliates.

All content is subject to copyright and may not be reproduced without prior authorization from UL Solutions or the content author.

The content has been made available for informational and educational purposes only. While the editors of this site may verify the accuracy of its content from time to time, we assume no responsibility for errors made by the author, editorial staff or any other contributor.

UL Solutions does not make any representations or warranties with respect to the accuracy, applicability, fitness or completeness of the content. UL Solutions does not warrant the performance, effectiveness or applicability of sites listed or linked to in any content.

It’s great that you elaborated on supply chain innovation. I can see how a company will try to improve its supply chain for better business. It would be interesting to know what most companies do to make their supply chain process more efficient.

Industrial lubricants industry is quite popular in USA, Canada and now booming in Asian regions. They are becoming important with the time and establishing of modern industrial setups. In the developing countries, mine lubricants, conveyor chain and hydraulic lubricants and oils are very much in demand and the awareness of best lubrication practice is developing quickly too. Thanks Harsha for writing such a detailed article on this important topic and sharing lubricant market trends.