This risk-averse industry shows fast growth potential for synthetic lubricant suppliers.

In the past 25 years, the wind energy industry has seen tremendous growth. According to the U.S. Energy Information Agency (EIA), wind power is now the second largest electricity source globally among all the renewable power sources. Further, the agency projects the industry’s share in the global net electricity generation from renewable power will increase to 19 percent in 2020 and 23 percent in 2040.

Looking for lubrication materials and equipment?

Additives, concentrates, solvents, testing equipment…Prospector® has listings for hundreds of products from global suppliers. Make your job easier and find everything in one place. Register today for access!

Lubricants and wind power

Wind turbine lubricants play a critical role in equipment operation, maintenance and reliability of a wind farm. There are a number of lubrication points in a wind turbine, including:

- gearbox

- open, pitch, & yaw gear

- rotor shaft

- hydraulic systems

- generator bearings

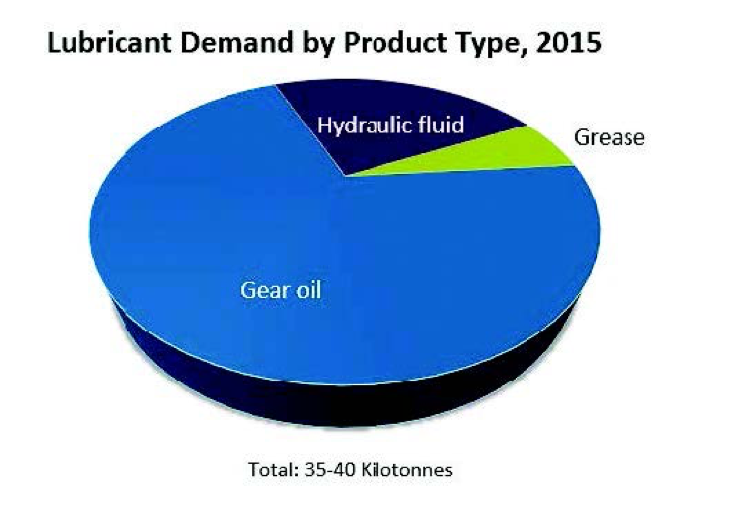

These points require various lubricants such as gear oils, hydraulic oils and greases. Improper or inadequate lubrication can result in significant costs or equipment downtime.

- Gear oil is used to lubricate gearboxes

- Grease is used on the main rotor shaft bearing, yaw bearing, pitch drive gears, blade bearing and generator bearing

- Hydraulic fluid is used in hydraulic systems to control blade pitch

Wind turbine lubricant demand

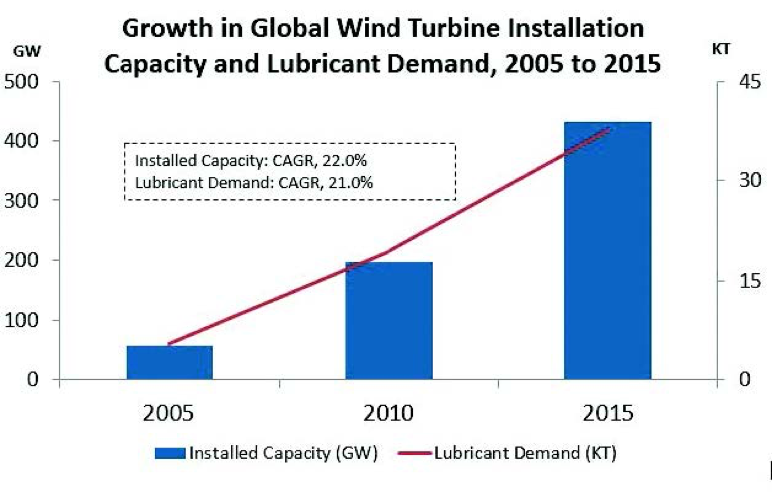

In 2015, global lubricant consumption in the wind energy sector was estimated to be between 35 and 40 kilotonnes. This consumption has grown in line with the wind power capacity growth, which has increased seven-fold from 59 GW in 2005 to close to 433 GW in 2015 (see Figure 1).

The most important lubricant category—gear oil—accounts for 70 percent of lubricant consumption (see Figure 2). When properly formulated, gear oil prevents failure and increases the reliability of the gearbox unit. Therefore, gear oils made from high quality synthetic base oils are most often used in the wind power sector.

Growth factors

Currently, oil drain intervals range from up to six years for onshore turbines and up to 10 years for offshore installations. The average drain interval will extend gradually as operators try to optimize lubricant consumption. Bear in mind that downtime costs are often greater than the cost incurred for lubricants. As the industry is risk averse, farm operators continuously try to balance operational cost and performance.

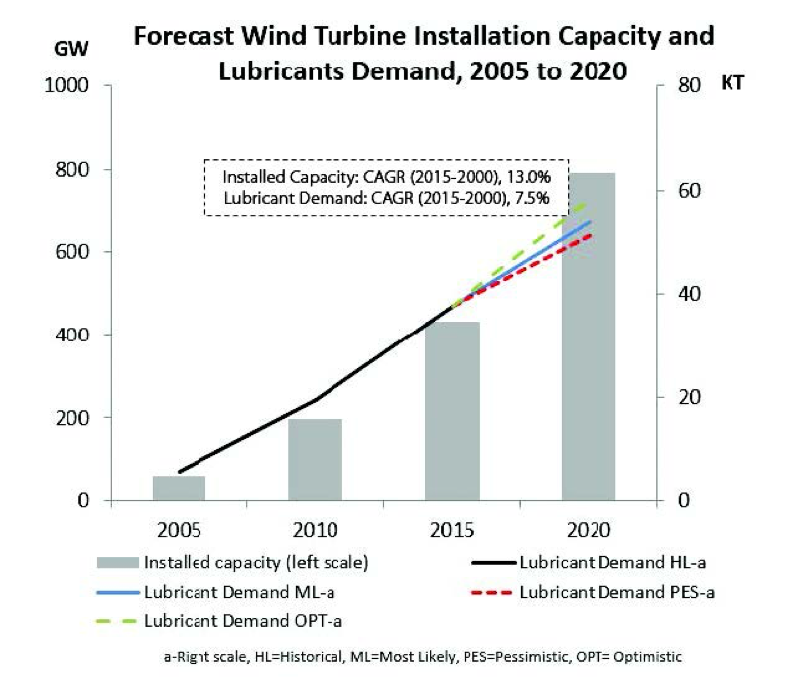

The most significant lubricant demand driver will be growth in wind power capacity. Global wind energy capacity over the next five years will grow at a CAGR of 13 percent (see Figure 3). Although the growth rate is lower than in previous years, it is still much faster than lubricant demand growth in both global industrial and other end-use industries. Some factors could hinder capacity growth, such as grid connectivity issues, availability of land for onshore installations and withdrawal of government support.

Wind power farms, due to their remote locations, suffer from poor grid connectivity problems in some countries. Grid expansion is not always able to keep up with the rate of growth, and this restricts the industry’s progress. For instance, in China about 25 percent of the capacity is not connected to the grid. This suggests that if China’s connectivity doesn’t improve in the future, wind industry’s growth could be relatively slower than expected.

The availability of appropriate sites for wind farms also is an issue as wind turbines can’t be located near population centers. This has led to the development of offshore wind farms. In addition, the industry is exploring the option of developing floating wind farms that will be able to operate in greater water depths and experience more consistent wind speed.

In recent years, the Spanish and U.S. governments have reduced monetary support to the wind power industry, but some benefits are still available. Government tax rebates, subsides and policy changes have been instrumental in the growth of wind power industry in any country. Therefore, withdrawal of government support could hamper the industry’s growth.

Competitive landscape

The wind turbine lubricants market is highly consolidated; the top five suppliers account for 85-90 percent of the market. These stakeholders include ExxonMobil, Shell and BP. The advantage these companies have over niche or regional suppliers include OEM-approved products, supply reliability, globally consistent quality and the ability to produce high-quality synthetic lubricants. A new lubricant supplier faces a high entry barrier due to long product-approval processes. Despite this, multiple mid-tier lubricant manufacturers have entered the market in the past five years.

Wind turbine lubricant challenges

Growth of offshore and floating turbines will add to the challenges associated with wind turbine lubrication. Moisture in a gearbox is a big problem because it leads to severe corrosion if not expelled from the system. Therefore, lubricant suppliers need to focus on developing more robust lubricants to help minimize gearbox failure. Wind farm operators also commonly report issues with dirt and water contamination of grease. However, these problems are more common with manual lubrication, versus automatic greasing systems. Proper training of maintenance professionals could help minimize these issues.

Conclusion and opportunities

Wind power is a high-growth industry and its lubrication needs are expected to trend in a similar fashion. The industry will drive demand for high-performance lubricants, with needs for product customization and after-sale services. Synthetic lubricant suppliers are in an excellent position as wind turbine lubricants use more synthetics than other industries.

This article features the highlights of a larger feature piece – find additional information, including the impact on direct drive, in the full Tribology & Lubrication Technology article: Positive outlook for wind turbine lubricants.

About the Author

Sushmita Dutta is project lead-energy for Kline. You can reach her at sushmita.dutta@klinegroup.com.

Sushmita Dutta is project lead-energy for Kline. You can reach her at sushmita.dutta@klinegroup.com.

Kline is an international provider of world-class consulting services and high-quality market intelligence for industries including lubricants and chemicals. Learn more at www.klinegroup.com.

The views, opinions and technical analyses presented here are those of the author or advertiser, and are not necessarily those of ULProspector.com or UL Solutions. The appearance of this content in the UL Prospector Knowledge Center does not constitute an endorsement by UL Solutions or its affiliates.

All content is subject to copyright and may not be reproduced without prior authorization from UL Solutions or the content author.

The content has been made available for informational and educational purposes only. While the editors of this site may verify the accuracy of its content from time to time, we assume no responsibility for errors made by the author, editorial staff or any other contributor.

UL Solutions does not make any representations or warranties with respect to the accuracy, applicability, fitness or completeness of the content. UL Solutions does not warrant the performance, effectiveness or applicability of sites listed or linked to in any content.

Leave a Reply or Comment